hotel tax calculator quebec

Recent taxi price calculations in Quebec. The hotel tax is 3 and the GST goods and services tax is 5 as well as TVQ Quebec sales tax which is 74Every Montreal hotel bill contains a 5 tax.

Sales Tax Updates Covid 19 Taxconnex

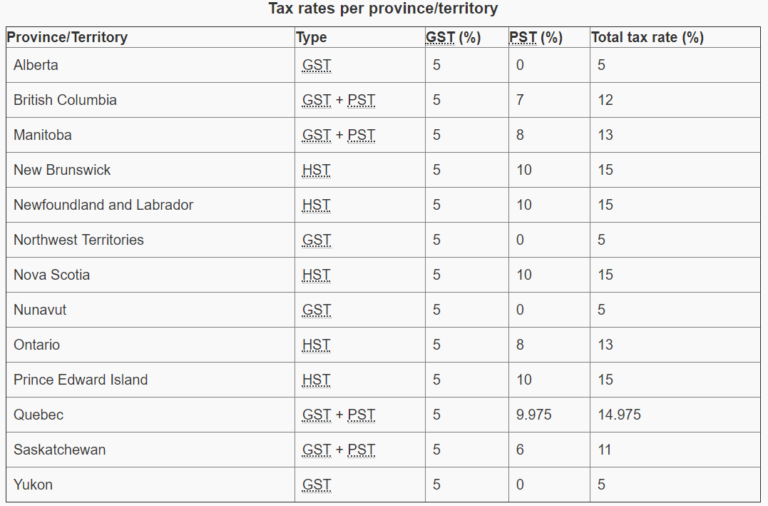

Type of supply learn about what.

. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. With the official today valid Taxi Rate Quebec. The rate you will charge depends on different factors see.

That means that your net pay will be 36763 per year or 3064 per month. You can easily estimate your net salary or take-home pay using HelloSafes calculator above. This is any monetary amount.

Over 42184 up to 84369. Ad Finding hotel tax by state then manually filing is time consuming. Avalara automates lodging sales and use tax compliance for your hospitality business.

Learn more about the Montreal Home Ownership program for first-time home buyers. The tax on lodging is calculated only on the price of the overnight stay. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at.

To calculate taxes in Quebec. Calcul taxes des résidents du Québec au Québec 2022 Vous aimez calcul conversion. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf.

With the official today valid Taxi Rate Quebec from January 2020. This is any monetary amount. Step 1 Find the non-taxed amount of the item you want to purchase.

Just enter your annual pre-tax salary. Basically 18999125 on hotel rooms. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

Quebec tax bracket Quebec tax rate. Over 117623 up to. Calcul taxes TPS et TVQ au Québec.

Formula for calculating the GST and QST Amount before sales tax x GST rate100 GST amount Amount without sales tax x QST rate100 QST amount Amount without sales tax GST. Over 84369 up to 96866. Calculator to calculate sales.

Over 96866 up to 117623. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. So it would be 100 - 10350 then.

35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January. Calculate land transfer tax welcome tax fees associated with buying a property in Quebec. Le TIP est au moins égal à.

Annual salary average hours per week hourly rate 52 weeks minus weeks of vacation - weeks of holidays For example imagine. If you are paying on meals the total tax would be 14975. Tax billed by the operator of an establishment 35 tax on lodging billed on the price of an overnight stay.

Avalara automates lodging sales and use tax compliance for your hospitality business. Plus Tax Amount 000. Before Tax Amount 000.

Tweeter Montant avanthors taxes TPS 5 TVQ 9975 Montant avec taxes La nouvelle. Step 2 Multiply 12. The formula for calculating your annual salary is simple.

So it would be 100 - 10350 then 518 GST and 1032 in QST for a total of 11900. This tool will calculate both your take-home pay and. Minus Tax Amount 000.

Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT. Income Tax Calculator Quebec 2021. The Quebec Income Tax Salary Calculator is updated 202223 tax year.

To be paid of persons person. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Amount with taxes amount.

For this example assume the price on the item is 12 CAD. This often is listed on a price tag on the item. The tax on lodging does not apply to the rental of a camp site.

Quebec GST 5 9975 QST PST The tax on lodging is usually 35 of the price of an overnight stay. By day 5400. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237.

The following table provides the GST and HST provincial rates since July 1 2010. Amount without sales tax. If youre selling an item and want to receive 000 after taxes youll need to sell.

Ad Finding hotel tax by state then manually filing is time consuming.

Updated For 2022 Your Guide To Taxes In Toronto Canada

Calculators Montreal Financial

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Statistics Canada Property Taxes

How Much Are Property Taxes In Mexico Zisla Blog

Quebec Sales Tax Calculator And Details 2022 Investomatica

What Are Sale Tax And Hotel Tax In Montreal Canada Ictsd Org

Statistics Canada Property Taxes

Don 039 T Forget These Tax Deductions For Your Airbnb Or Other Short Term Rental

How Much Is Hotel Tax In Montreal Lexingtondowntownhotel Com

Statistics Canada Property Taxes

Payroll Tax Q Series Robust Tax Engine Vertex Inc

Quebec Sales Tax Calculator And Details 2022 Investomatica

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

Littoral Hotel Spa Quebec Qc 3710 Ste Anne G1e3m3